Finance for Beginners: The Basics of Insurance

8 mins read

Published on Jul 30, 2024

Introduction

Imagine this. You recently bought your very first car—a sleek, beautiful vehicle that you had desired for years. A couple of months later, someone hits you from behind at a stoplight. Now, you have issues with car repairs, and medical bills are piling up. Without insurance, you know you're in a lot of trouble.

The scenario above is one of the many reasons why you need to have some sort of insurance plan. In fact, the National Association of Insurance Commissioners recently recorded that more than 60% of Americans who filed for bankruptcy cited medical expenses as a major factor. It's not exactly rocket science, nor is it the most exciting topic, but knowing about insurance will save you some headaches and even more money. So, let us break it down in really simple terms.

What is Insurance?

Insurance provides a means of making provisions for security against contingent factors such as accidents. Insurance can be thought of in this way: you give a little bit of your money to a company, and in return, they help you cover the costs of whatever unfortunate situation you may find yourself in. It means being insured provides a financial backup plan to cover the costs of life.

Basic Concepts in Insurance

• Premiums: Premiums are what you pay monthly, quarterly, or yearly to maintain your insurance. Obviously, the premium amount will be different depending on your coverage type, your age, your health, or even your driving record. You can consider this a subscription fee for your security blanket. For example, young drivers or good-status record holders usually pay lower premiums.

• Deductibles: A deductible is what you pay out of pocket before your insurance covers you. Say you have a $500 deductible and your car needs a repair worth $1,500; in that case, you pay $500 while the insurance company covers $1,000. Think of it like a starting line you have to cross to get financial help from your insurance. Also, the higher the deductible, the lower the premium you will be charged each month. Just make sure to have enough pocket money to meet the out-of-pocket cost when needed.

• Policy Limits: This is the maximum amount your insurance policy will pay in the event of a covered loss. Say you have $50,000 worth of coverage in your auto policy and you cause an accident; under such circumstances, that is the most your insurer will compensate for in damages or injuries. Knowing what your policy limits are allows you to purchase enough coverage so as not to endure a huge financial loss if something happens.

• Exclusions: These are any conditions, limitations, or circumstances that are specifically noted as not being covered by your insurance policy. For instance, a house insurance policy may not provide indemnification against flood or earthquake damage; you would need to buy this separately. Just remember, no matter what the insurance is for, always read the fine print on what's excluded. Sometimes it might be worth considering other policies in such cases.

• Beneficiary: This is very common for someone who has life insurance. A beneficiary refers to any person or entity to whom you would want the money from your policy to go when you die. It's important to update this often so your benefits are distributed properly. Keep reviewing and updating your beneficiaries to show your life updates.

Types of Insurance

There are many varieties of insurance based on various aspects of your life. These range from:

1. Health Insurance: This allows one to pay for medical expenses, from visits to the doctor to even hospitalization. Then there are different plans, like HMO or PPO plans, that have their own benefits. For instance, generally, HMO plans offer lower premiums, but you must see only doctors from within their network. PPO plans generally give you wide latitude in choosing doctors, but at a slightly higher premium. Health insurance may become very important since healthcare is so expensive. A Kaiser Family Foundation study reported that the average annual premium for employer-sponsored health insurance in 2021 was $7,739 for single coverage and $22,221 for family coverage.

2. Auto Insurance: This is for all vehicle owners. It covers damage to your car and can be used to help pay for others' bodily injuries or property damage if you have an accident. While liability is directly required by law, there are many different types of coverage available to the person seeking insurance. Some others include non-collision damage, also called comprehensive coverage, and collision, which will repair your vehicle if it is actually damaged in an accident. Choosing the right coverage is just as important as getting insurance in the first place. According to the Insurance Information Institute, the average cost of auto insurance in the U.S. is around $1,056 per year.

3. Homeowners/Renters Insurance: If you own a home, this insurance will help protect damage to your house and belongings. If you rent, it is referred to as renters insurance because it covers a person's personal items inside a rental property. What that means is that if, for example, your apartment was gutted by fire, the renter's insurance would replace your stuff. Note that natural disasters like floods and earthquakes generally require extra coverage. According to the National Association of Insurance Commissioners, the average annual premium is somewhere around $1,200 for a homeowner's insurance.

4. Life insurance: Should you pass away, having life insurance would ensure your family's financially okay. It can assist in covering funeral expenses, other debts, and probably providing income for your family. Term life insurance works by giving coverage for a limited or specified period. Alternatively, whole life insurance, covers your whole life and accrues monetary value. As recorded by the Life Insurance Marketing and Research Association, about 54% of Americans own life insurance.

5. Other Types: There are numerous insurance options, such as, disability insurance, which provides you with an income in the event that a health issue prevents you from working; travel insurance, which may compensate you should you have to cancel a trip or when a medical emergency occurs while traveling elsewhere; and even pet insurance, which will help cover veterinary expenses. Each type caters to different needs, making sure that every possible scenario is covered.

Why You Need Insurance

Having insurance is necessary if you want to manage risks. Life is full of surprises, and having insurance will help you manage any unforseen financial risk. Imagine, for example, that you have an accident with your car, you fall ill, or your house gets damaged—the cost could be huge.

Insurance provides a buffer, so you don’t have to bear the entire cost alone. As a matter of fact, it gives you peace of mind. You will live your life to the fullest and probably not stress as much when you know there is somebody to back you up in case of emergencies. Again, there are other types of insurance, like auto insurance, that the law requires one to have.

Conclusion

Learning the basics of insurance is important for you. Know what insurance is, its key concepts, and why you need it to make informed decisions about your coverage. In our next post, we will finish with an overview of how insurance works, coupled with the option for the policy best for you.

Last updated: Jul 30, 2024

Share this with your friends and family

Join the money party

Level up your financial game with our exclusive blog updates, delivered straight to your inbox

Other articles you might enjoy

Join the #1 banking app for the Commonwealth

Get started on Plently

Rosemary D.

Phia Consultants

It's like having the best financial partner in my pocket!

Jonathan G.

Open Space Inc

Plently has truly transformed my financial life.

Emily H.

Student

With their user-friendly interface and innovative tools, managing my money has become a breeze.

Margaret D.

Small Business Owner

I finally feel in control of my finances, thanks to Plently!

Alexander P.

Small Business Owner

After Plently, I can't imagine going back to traditional banking!

Oliver A.

Student

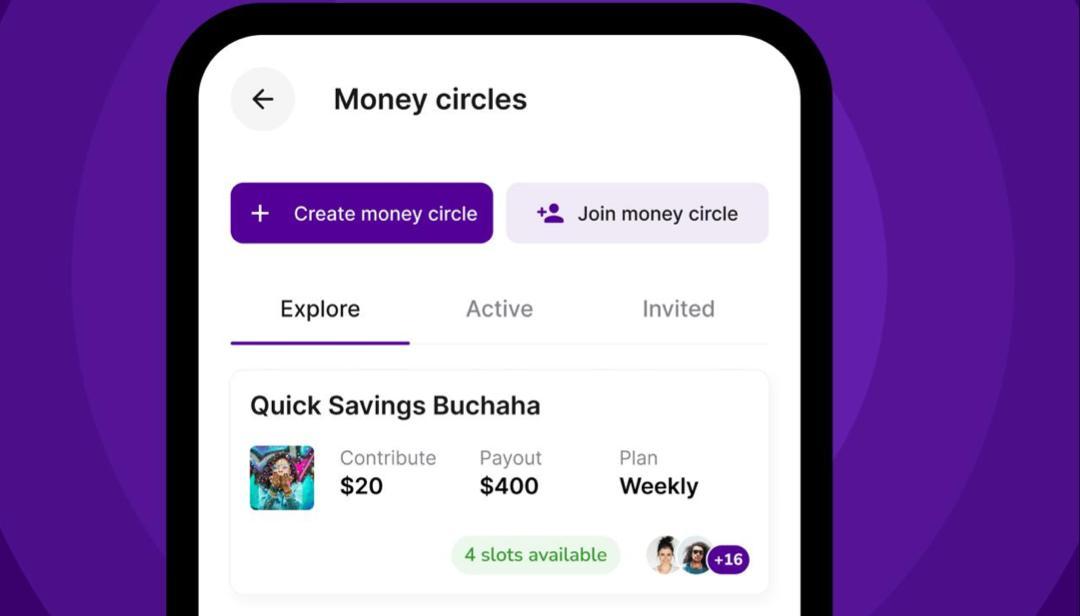

Being a part of a Money Circle has been a game-changer for me. It's not just about financial contributions; it's a supportive community working together towards shared goals

Loading comments...